Micro-onde encastrable grill MIELE - M 8261-2 IN • Micro-onde encastrable • Micro-ondes - Cdiscount Electroménager

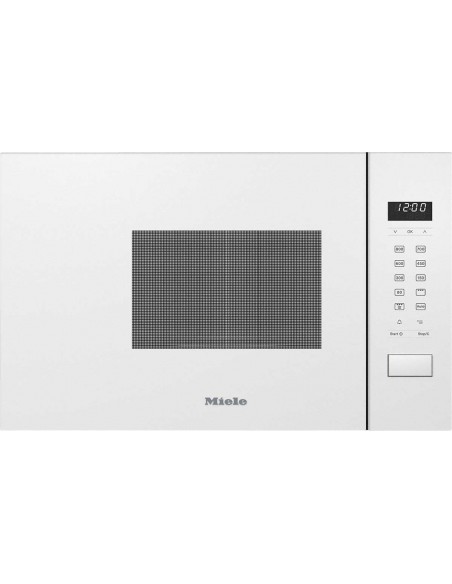

Four micro-ondes Miele M 2234-60 SC blanc - Vente et dépannage Genève Frais de livraison (Genève uniquement) Livraison et débarras de l'ancien appareil (CHF150.-) TAR incluse

Micro-ondes encastrable pour meuble haut de 60cm et profondeur mini de 50cm. AEG MBE2658SEM - Meg diffusion